Decoding the Fintech Landscape: Current Trends and Future Projections

Imagine a financial world where transactions are seamless, personalized, and secured by cutting-edge technology—that’s not some distant future; it’s unfolding right now. The fintech industry is experiencing a colossal shift, driven by advancements in AI and blockchain technologies, and it’s reshaping how we think about financial services.

Recent market projections paint a vivid picture: the fintech sector is expected to soar to a staggering $1.5 trillion by 2030. In 2024 alone, investments in fintech reached an impressive $52 billion, signaling strong confidence in the industry’s potential. This growth isn’t merely about numbers; it’s about the transformative impact on how businesses and consumers interact with financial systems.

Consider these trends shaping the landscape:

- Increasing Digital Transactions: With 73% of bank transactions now occurring online, the demand for efficient and secure mobile solutions is at an all-time high.

- AI Integration: Artificial intelligence is revolutionizing customer experiences through personalization and automation, enabling services that adapt to individual user needs in real-time.

- Blockchain Adoption: Beyond cryptocurrencies, blockchain is enhancing security and transparency in transactions, building trust in digital financial services.

As one industry expert aptly put it, "Fintech is a super-interesting category right now." The fusion of technology and finance is opening doors to innovations that were unimaginable just a few years ago.

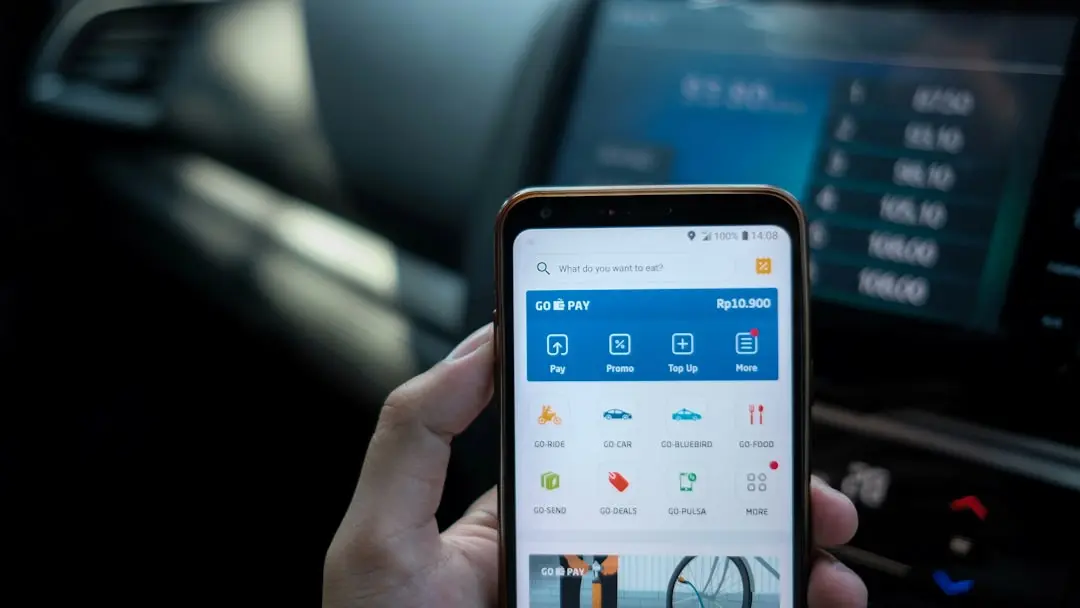

Mobile applications stand at the forefront of this evolution. They’re not just tools but essential platforms that facilitate accessibility and engagement. According to a recent analysis, the rise of mobile fintech apps is a key driver in the industry’s expansion, offering users unprecedented convenience and personalized services.

For leaders aiming to navigate and leverage these trends, it’s vital to stay informed and agile. Embracing technological advancements today can position your organization ahead of the curve, ready to capitalize on the opportunities that this fintech revolution presents.

Meeting Modern Demands: How Innovative Mobile Apps are Transforming Fintech

In an era where smartphones are ubiquitous, consumers expect their financial services to be as mobile and dynamic as their daily lives. This shift is pushing the fintech industry to innovate like never before, especially in the realm of digital banking and personal finance management.

Today’s users are not just looking for basic transaction capabilities; they crave personalized experiences that cater to their individual financial goals. As one industry expert poignantly noted, "Customers want more than just transaction capabilities in banking apps."

Statistics underscore this trend. By 2025, digital banking is projected to cover 80.4% of the U.S. population, reflecting the immense demand for mobile financial solutions. Moreover, 89% of consumers already use digital banking services, signaling a robust user base that values convenience and accessibility.

Millennials, in particular, are driving this demand for personalization. A striking 65% of millennials prefer tailored financial services that resonate with their unique needs. This preference presents an opportunity for fintech companies to differentiate themselves by offering customized features that enhance user engagement and foster loyalty.

To meet these modern demands, innovative mobile apps are integrating advanced functionalities such as AI-driven budgeting tools, investment trackers, and secure payment options. These apps are not just managing money; they are empowering users to make informed financial decisions.

Here’s a snapshot of the current landscape:

| Key Statistic | Impact on Fintech |

|---|---|

| Digital banking covers 80.4% of U.S. population by 2025 | Expanding user base demands more sophisticated apps |

| 65% of millennials prefer tailored financial services | Need for personalized features to attract this segment |

| 89% of consumers use digital banking | High adoption rate encourages further innovation |

For financial leaders, embracing these innovations is more than just staying current—it’s about anticipating customer needs and delivering solutions that exceed expectations. By investing in the development of versatile and user-centric mobile applications, fintech companies can not only meet but shape consumer demands in this evolving digital landscape.

For insights on emerging fintech app ideas, explore this detailed analysis.

Unleashing AI: Transforming Fintech Apps into Intelligent Solutions

Imagine interacting with a financial app that not only understands your needs but also anticipates them—a level of personalization once considered science fiction. This is the transformative power of AI in fintech applications today. The integration of artificial intelligence is not just enhancing functionalities; it’s fundamentally reshaping how users engage with financial services.

One of the most prominent examples is the use of intelligent chatbots. These virtual assistants provide immediate, personalized customer support, handling queries and performing tasks with remarkable efficiency. They learn from each interaction, continually improving their ability to assist users, which significantly elevates the customer experience while reducing operational costs.

But the influence of AI extends beyond customer service. Predictive analytics enables fintech apps to offer tailored financial insights by analyzing vast datasets to identify patterns and forecast trends. This empowers users to make informed decisions regarding investments, savings, and risk management, transforming data into actionable strategies.

Speaking of risk management, AI-driven algorithms are revolutionizing how financial institutions detect and prevent fraud. By identifying unusual patterns in real time, AI systems can thwart fraudulent activities before they cause harm, bolstering security and building trust with users.

The impact of these innovations is reflected in the numbers. AI in fintech is projected to reach $22.6 billion by 2025, highlighting the sector’s rapid growth and investment. Furthermore, a remarkable 60% of U.S. consumers are now using AI-driven fintech services, embracing the enhanced capabilities and personalization they offer.

As one industry expert insightfully noted, "User-centric design ensures fintech apps meet users’ needs effectively." It’s this marriage of advanced technology and a deep understanding of user expectations that is propelling fintech into a new era.

For leaders in the financial sector, integrating AI into mobile applications isn’t merely an option—it’s becoming an essential strategy to stay ahead in a competitive market. By leveraging AI’s potential, businesses can deliver intelligent solutions that not only meet but exceed user expectations, fostering loyalty and driving growth.

Typical topics we cover during consultation:

- How can I use AI to automate my company’s business processes?

- Which functionalities of my application should I enhance with AI?

- Rapid verification of the application code quality

- Why are there so many errors in my application?

- Am I ready for MVP development?

Safeguarding Success: Navigating Fintech App Development Challenges

In the exhilarating race to innovate within the fintech arena, it’s easy to get caught up in the possibilities and overlook the hurdles that lie ahead. Yet, for any fintech endeavor to truly thrive, addressing critical challenges like regulatory compliance and data security is not just prudent—it’s imperative.

Navigating the complex web of financial regulations can be daunting. Laws and guidelines vary not only by country but often by region, and staying compliant is a moving target as regulations evolve alongside technology. Non-compliance isn’t an option; beyond hefty fines, it can erode credibility and user trust, two pillars upon which successful fintech solutions are built.

Data security is another formidable challenge. With 74% of users expressing concern over app security issues, it’s clear that safeguarding user information is paramount. In an industry where transactions involve sensitive financial data, a single breach can have catastrophic consequences—not just financially, but in terms of brand reputation and customer loyalty.

As one thought leader aptly stated, "Technological innovations will be the heart and blood of the banking industry." This underscores the dual responsibility of fintech companies: to innovate while also fortifying their platforms against potential threats.

So, how can companies effectively tackle these challenges? One strategy is to adopt a proactive approach to compliance by integrating regulatory considerations into the early stages of app development. This means collaborating with legal experts who specialize in fintech to ensure that every feature aligns with current laws and anticipates future changes.

On the data security front, implementing robust encryption protocols and conducting regular security assessments can go a long way in protecting user information. Additionally, transparent communication about security measures can enhance user trust, reassuring customers that their data is handled with the utmost care.

Companies like Leaware exemplify this balanced approach. By prioritizing both innovation and security, they’ve managed to deliver cutting-edge fintech solutions that users can trust. Their commitment to understanding and integrating compliance requirements has been a key factor in their success.

For leaders in the fintech space, the takeaway is clear: investing in compliance and security isn’t a sideline activity—it’s central to building a sustainable and reputable business. By addressing these challenges head-on, companies not only protect themselves but also create a solid foundation for growth and customer loyalty.

Understanding the nuances of fintech app development is crucial for success.

Beyond Boundaries: Embracing the Future of Fintech Innovation

As we stand on the cusp of a new era in financial technology, the question isn’t just what’s next, but how to stay ahead in a landscape that’s evolving at breakneck speed. The future of fintech is not a distant horizon—it’s unfolding before us, propelled by relentless AI advancements that are reshaping every facet of the industry.

Artificial intelligence continues to be the catalyst for innovation within fintech. With projections indicating that AI-driven financial services will experience exponential growth, organizations that harness this technology stand to redefine user experiences and operational efficiency. AI is not just a tool for automation; it’s the engine driving personalized services, predictive analytics, and intelligent decision-making that can adapt to market changes in real time.

One industry leader aptly remarked, "Continuous iteration is key to staying relevant in the fintech space." This ethos underscores the necessity for fintech companies to remain agile, embracing new technologies and methodologies to keep pace with or even outpace the competition. The integration of AI into mobile applications, for instance, is opening up possibilities that were mere concepts a few years ago—like real-time fraud detection, voice-activated transactions, and even emotion-aware customer service interfaces.

Looking ahead, the convergence of AI with other emerging technologies like blockchain and the Internet of Things (IoT) is set to unlock unprecedented opportunities. These innovations promise not only to enhance security and transparency but also to create more inclusive financial ecosystems that reach underserved populations.

For CEOs and CFOs steering their organizations into this future, the imperative is clear: invest in innovation today to be the leaders of tomorrow. Staying informed about emerging trends and being willing to adopt cutting-edge solutions will be crucial. Exploring insightful resources, such as this comprehensive guide on pioneering fintech app ideas, can provide valuable perspectives on how to navigate this rapidly changing landscape.

Embracing the future isn’t just about adopting new technologies; it’s about fostering a culture of innovation that permeates every level of the organization. By doing so, financial institutions can not only adapt to the changing tides but also shape the future of fintech themselves.

Download your whitepaper

- Learn why software development and JTBD theory are important for your business’ product success

- Discover how to make sure your product will have a good impact on the market

- Discover how to make sure your product will make your users happy when getting the job done