Introduction to Gamification in Fintech

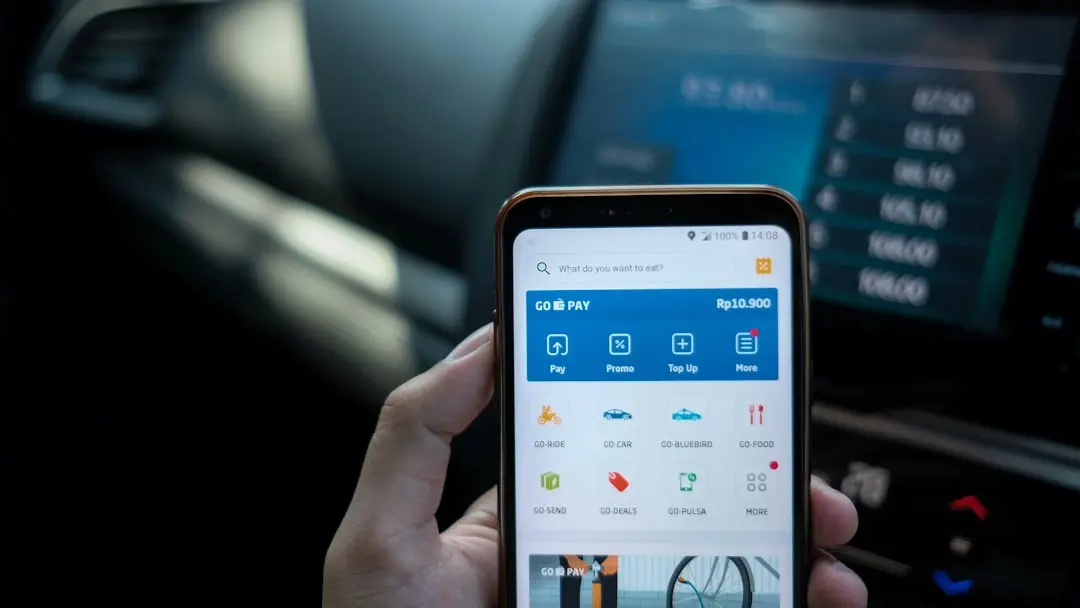

In today’s digital landscape, where every interaction is an opportunity to captivate, gamification strategies for financial apps are revolutionizing user engagement. But how exactly does gamification transform the way users interact with fintech applications? By integrating game-like elements such as points, badges, and leaderboards, fintech platforms are not only making financial tasks more enjoyable, but they are also significantly boosting user engagement and loyalty. For example, research shows that adding game elements to finance apps can enhance user interaction by up to 40%. This impact is particularly evident in apps like Revolut, where users engaging with gamification are 2.5 times more likely to stay active. Such strategies tap into our natural love for games and competition, turning mundane financial tasks into exciting challenges. As fintech companies continue to innovate, the benefits of gamification in finance apps are becoming increasingly clear, offering a pathway not just to retain users, but to foster a loyal community that thrives on interaction and achievement.

In today’s digital landscape, where every interaction is an opportunity to captivate, gamification strategies for financial apps are revolutionizing user engagement. But how exactly does gamification transform the way users interact with fintech applications? By integrating game-like elements such as points, badges, and leaderboards, fintech platforms are not only making financial tasks more enjoyable, but they are also significantly boosting user engagement and loyalty. For example, research shows that adding game elements to finance apps can enhance user interaction by up to 40%. This impact is particularly evident in apps like Revolut, where users engaging with gamification are 2.5 times more likely to stay active. Such strategies tap into our natural love for games and competition, turning mundane financial tasks into exciting challenges. As fintech companies continue to innovate, the benefits of gamification in finance apps are becoming increasingly clear, offering a pathway not just to retain users, but to foster a loyal community that thrives on interaction and achievement.

Benefits of Gamification in Finance Apps

The benefits of gamification in finance apps are truly transformative, turning routine financial tasks into engaging experiences that significantly enhance user interaction and retention. By employing game-like features such as badges, leaderboards, and challenges, fintech apps are able to increase user engagement by up to 40%. This gamified approach not only makes managing finances more enjoyable but also builds user loyalty through gamification in fintech. For instance, Monzo users utilizing gamified savings features have been able to boost their savings by 30%. These strategies not only improve user satisfaction but also promote steady app usage, creating a habit-forming experience. As fintech companies continue to evolve, embracing gamification is proving to enhance the user experience by making financial processes more interactive and rewarding. For more insights on innovative mobile app trends, explore our article on Innovative Mobile App Development Trends for Startup Growth in 2024.

The benefits of gamification in finance apps are truly transformative, turning routine financial tasks into engaging experiences that significantly enhance user interaction and retention. By employing game-like features such as badges, leaderboards, and challenges, fintech apps are able to increase user engagement by up to 40%. This gamified approach not only makes managing finances more enjoyable but also builds user loyalty through gamification in fintech. For instance, Monzo users utilizing gamified savings features have been able to boost their savings by 30%. These strategies not only improve user satisfaction but also promote steady app usage, creating a habit-forming experience. As fintech companies continue to evolve, embracing gamification is proving to enhance the user experience by making financial processes more interactive and rewarding. For more insights on innovative mobile app trends, explore our article on Innovative Mobile App Development Trends for Startup Growth in 2024.

Gamification Strategies for Financial Apps

Typical topics we cover during consultation:

- How can I use AI to automate my company’s business processes?

- Which functionalities of my application should I enhance with AI?

- Rapid verification of the application code quality

- Why are there so many errors in my application?

- Am I ready for MVP development?

User Loyalty Through Gamification

Future of Gamification in Financial Technology

Download your whitepaper

- Learn why software development and JTBD theory are important for your business’ product success

- Discover how to make sure your product will have a good impact on the market

- Discover how to make sure your product will make your users happy when getting the job done