Introduction: Understanding Stripe and Adyen

Payment Platforms Unveiled: A Deep Dive into Stripe’s Features

Unarguably, one of Stripe’s significant strengths lies in its robust customer portal. Serving 42 countries and processing payments in 135 different currencies, it’s undeniably a global platform. The client portal simplifies subscription management processes — from adjusting plans to processing cancellations. Stripe’s vigilant fraud protection offers substantial support to its millions of customers worldwide. The system leverages an AI-driven fraud detection model, called Radar, which has blocked more than a billion in fraudulent activities since its debut.

Most remarkably, Stripe’s forte is its global payments facilities. This breakthrough has given them the half-hand to arguably transmute the payment processing realm. For example, in 2020, it facilitated transactions up to $350 billion in value, rendering it a huge player in the payments industry. To put things into perspective, this figure mirrors the GDP of Denmark, according to the World Bank.

The impressive functionality of Stripe allows us to form an appreciative stance towards the company. However, an effective strategy is to continually scrutinize its potential improvements while recognizing its present strengths to foster success. This fine-tooth comb approach, ultimately, allows businesses to ascertain the most efficient and effective methods of integrating Stripe’s multitude of services into their operations.

Exploring Adyen’s Strength: Standout Features

Adyen’s end-to-end infrastructure connects directly to Visa, Mastercard, and virtually all payment methods adopted worldwide. The strength of this single-platform design lies in its seamless global payment processing, coupled with advanced risk management for securing transactions—a true game-changer for businesses aspiring to penetrate new markets. Furthermore, Adyen also provides a range of white-label services, facilitating businesses large or small to cultivate their brand’s uniqueness.

Arguably, one of Adyen’s most impressive facets is its advanced risk-management system. In 2019 alone, using this system, Adyen prevented approximately $1.3 billion in potential fraud, states a Fortune article. With fraud constituting a grave concern for businesses of all sizes, this proven capability of Adyen offers a layer of security that is hard to rival.

Amid the cut-throat payments landscape, Adyen has masterfully presented a platform that not just grasps the diverse payment methods the world offers, but accepts and implements them holistically. Such comprehensive functionality, combined with the promise of robust risk identification and protection, certainly situates Adyen as a formidable contender.

Adyen’s groundbreaking technologies may just be the edge businesses need, equipping them to widen their audience reach, fortify their transactions, and ultimately gain unprecedented traction in the relentlessly dynamic world of digital commerce.

Typical topics we cover during consultation:

- How can I use AI to automate my company’s business processes?

- Which functionalities of my application should I enhance with AI?

- Rapid verification of the application code quality

- Why are there so many errors in my application?

- Am I ready for MVP development?

Transaction Costs: Comparing Stripe and Adyen’s Pricing Models

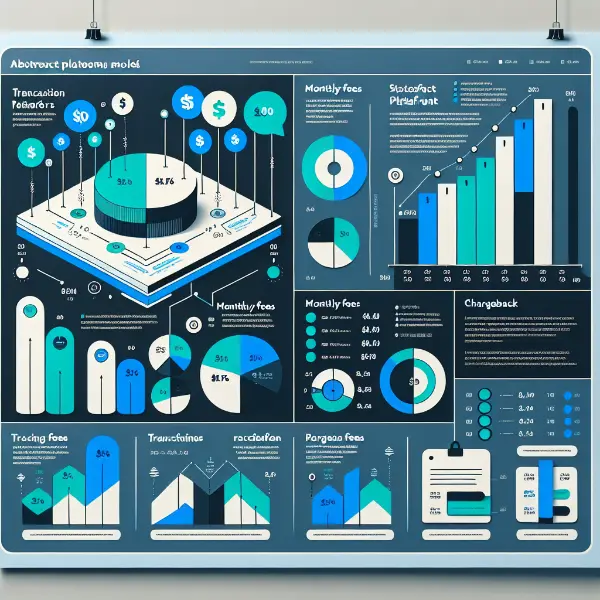

Let us move our focus towards Adyen’s monthly costs. With their intrinsic belief in transparent conduct, they charge no setup, monthly, or annual fees. The monthly minimum invoice amount, another integral part of this comparison, stands waived off for the first 12 months, subsequently amounting to a minuscule €100. The only other notable expense, undeniably, is the chargeback fee amounting to €25 per insight, offering an immense cost advantage for businesses battling chargeback issues.

Now, to comprehend the expansive utility of these costs, apply them to the backdrop of reach, service-quality, and functionality provided by Adyen. You’d tread beyond the conventional realm of cost comparison and gaze upon a platform that presents an incomparable blend of economical and valuable services. Adyen turns the tables around by saving businesses a potential of $5.6 billion a year by minimizing cases of fraud, as stated in their Risk Management Report.

Establishing a more nuanced understanding of service quality against cost, Adyen remarkably offers for an affordable investment, comprehensive coverage, superior security, and the promise of scalable growth. Can there be a cost more justified than this, designed to bolster your brand’s expansion while safeguarding your transactions? In essence, through its innovative practices and adaptable secure platform, Adyen is pushing the boundaries, rewriting the rules, and redefining the game in the world of digital transaction platforms.

Scalability through API: Stripe vs Adyen

Extending its services to over 42 countries, Stripe’s API effortlessly integrates a complex network of financial institutions, making it a preferred choice for the developers worldwide as corroborated by over 35% of global companies according to a report by the MIT Technology Review. The ease of integration and the promising scalability of Stripe’s API can be further exemplified considering that 4 out of 5 businesses, constructed on modern infrastructure, including Shopify and Amazon, have incorporated Stripe as their payment solution.

While both, Stripe and Adyen, offer a wide range of analytics and reporting tools, Stripe excels in a more user-friendly interface and detailed documentation, thus providing a deeper understanding of the transaction flow. Moreover, it provides provision to automate the financial operations via machine learning, thus saving nearly $10 billion for its users annually, as outlined in their Yearly Impact Report.

Therefore, when it comes to scalability, despite both platforms offering immense value, we can draw distinct parallels. Stripe, with its powerful API, seamless integration and intuitive interface, appeals to businesses seeking scalability with minimal complication. Adyen, though loaded with a multitude of features, more complex pricing, and deep global penetration, offers a more sophisticated solution for businesses on the path of rapid global expansion.

In conclusion, these two platforms appear to strike a balance between value and adaptability, each holding its own set of strengths and benefits. Therefore, while observing the strategic decisions around scaling a business, Stripe and Adyen’s APIs emerge as powerful tools in the world of digital finance, their ultimate effectiveness defined by the unique requirements of an organization.

Stripe and Security: An Analysis

Keen on maintaining the highest level of trust, Stripe is certified as a PCI Level 1 Service Provider, the most stringent level of certification available in the payments industry. Emphasizing on this, it is worth noting that in a recent survey by Fortunly, around 46% of Americans reportedly suffered from credit card fraud in the past 5 years, affirming the importance of high-level security measures employed by Stripe.

Fending off fraudulent transactions with the use of machine learning-based Stripe Radar, which evaluates hundreds of signals about each charge to identify suspicious activities, helps impose an added layer of security. This system proved to be meticulous, reducing fraud by 25% in 2019, as stated in Stripe’s 2019 Impact Report.

Summarizing, Stripe’s sturdy security measures, validated by data and certifications, contribute massively to its reputation. Alongside the new-age API, Stripe leaves no stone unturned in ensuring secure and risk-free transactions. Whether it’s their top-grade encryption methods, PCI compliance or their advanced fraud detection tactics, every step lends itself to the creation of a safe and stable environment for seamless financial operations. Indeed, Stripe’s security side emanates a human touch in an otherwise machine-dominated sphere, building a more reliable and, ultimately, humane digital finance landscape.

Secure Transactions with Adyen

In addition to Adyen’s strict adherence to global regulations, they leverage cutting-edge technologies like tokenization to bolster payment security. Tokenization, as explained by PCI Security Standards, replaces sensitive data with unique identification symbols that retain essential information without compromising security.

In terms of numbers, the effectiveness of Adyen’s security measures speaks volumes. For instance, a 2019 survey by Cybersecurity Insiders revealed that tokenization usage significantly reduced the data breach scope by a remarkable 84%.

Also, in the same 2019 report, tokenization was ranked as the second most effective data protection method, just slightly behind encryption, with 87% of respondents agreeing to the efficacy of the technique.

Substantiating this data, Adyen’s security practices provide high assurance of their commitment to data protection. Whether it’s using advanced encryption methods, adhering to international standards, or leveraging next-gen technologies such as tokenization, Adyen upholds its lofty promise of secure and seamless digital transactions. Like Stripe, Adyen’s human-centric approach lends a touch of reliability, making digital finance a more secure space for everyone.

Integrations: Stripe’s Compatibility with Other Platforms

Stripe is not only capable but also highly adaptable. It lives up to its “payments infrastructure for the internet” slogan by skillfully weaving into various business systems. It works smoothly with platforms like Shopify, a popular e-commerce website builder, and Xero, a cloud-based accounting software, thus seamlessly integrating into existing ecosystems businesses already employ.

The total number of Stripe integrations reaches a staggering 1,500, underscoring Stripe’s compatibility prowess. A 2020 report by FinancesOnline declared Stripe a leader in software integrations, highlighting its ability to adapt to different operational needs and structures. Stripe’s open API framework also enables customized integrations, allowing businesses to build unique, feature-rich payment platforms suitable for their specific needs.

Although two sides of the same coin, Stripe’s and Adyen’s approaches to security and compatibility underscore their contributions to the current digital infrastructure. The integration and security measures employed by both companies not only significantly elevates their efficacity but also reinforces their place as vital and reliable players in the digital finance field. It’s these technological strides that strengthen the foundations of e-commerce, offering businesses security and adaptability in an ever-evolving digital landscape.

Cross-platform Synergy: Adyen’s Integration Capabilities

The strength of Adyen lies in its integrational proficiency; a capability that extends to numerous leading e-commerce platforms. A perfect example is the integration with Magento, one of the most powerful open-source e-commerce platforms in the world, that facilitates businesses to offer a flawless customer payment experience. Another significant integration is with the customer relationship management software Salesforce, which can help businesses improve customer retention rates and stimulate customer loyalty through the provision of seamless transactions.

The integration with Zuora subscription management platform is another noteworthy example, allowing businesses to manage recurring billing and subscription management in one place. These multiple integrations serve as a testimony to how Adyen can streamline and simplify payment processes while bringing unmatched value to businesses.

Adyen’s efforts to integrate with numerous platforms, just like Stripe’s, have been critically beneficial. A 2018 report indicated that businesses integrating Adyen experienced on average a 1.3% increase in authorization rates and a 0.5 decrease in false decline rates. Considering that businesses are growing in complexity and volume, the value of integrated payments cannot be overstated.

In conclusion, both Adyen and Stripe prove to be multidimensional, with their strengths lying not just in security but also in their broad range of integrations. These integrations simplify the payment process by providing tailor-made solutions, thus enhancing the degree of customer experience businesses can offer, making them invaluable allies in the e-commerce landscape.

Final Verdict: Stripe or Adyen?

Among these integrations, the one with Magento is especially significant. Cultivating a reputation as one of the most robust open-source ecommerce solutions globally, Magento’s integration with Adyen furnishes businesses with a customer payment experience that is seamless and efficient. Meanwhile, Adyen’s alliance with Salesforce, a prominent customer relationship management software, is geared towards reducing attrition rates and bolstering customer fidelity, offering immaculate transaction processes.

Not to be overlooked is its collaboration with Zuora, a platform renowned for managing recurring billing and subscription systems effectively. These integrations testify to Adyen’s ability to streamline the intricate nuances of payment processes, conferring unmatched value to businesses making the eCommerce plunge.

A 2018 survey revealed that businesses integrating Adyen witnessed an average increase of 1.3% in authorization rates and a reduction of 0.5 in false decline rates. These figures, albeit minimal, are vital considering the increasing complexity of businesses and the sheer volume of transactions they handle. The value of such integrative payment methods, therefore, can hardly be exaggerated.

In essence, both Adyen and Stripe, with their security provisions and wide array of integrations, establish themselves as indispensable assets to the ecommerce fraternity. By simplifying the payment process via tailored solutions, they amplify the quality of customer experience businesses can deliver, establishing their integral role in the ecommerce ecosystem.